Our Newsletters

If you want to be added to our Newsletter Email list,

If you want to be added to our Newsletter Email list,

Contact Us and ask us to add you to our list.

2024 Market Outlook Spring (03-28-2024)

Take the Win and Be Happy. Let's go out and enjoy the outdoors before the heat comes roaring in. We probably have about six to seven weeks. You know I look back on January 12th when I came out with my stock market prediction, which I do every year, which is a real ...CONTINUE READING

2024 Stock Market Predictions (01-12-2024)

In 1968, Yale Harsch introduced the concept, or the phenomenon, of the Santa Claus Rally. It was a rally held in the last couple of weeks of December. While it does....CONTINUE READING

Bank Bear Trap (03-16-2023)

We watched the regional bank industry experience a "Back to the Future" event. You remember the financial crisis when banks failed in 2008. Fortunately, it is not as bad as 2008, but perhaps it could have been avoided .....CONTINUE READING

January 2023 Barometer- Myth or Reality? (02-01-2023)

Drip, drip, drip. Before I get to the January 2023 Effect, let's just recap last year. As you probably know, nothing good happened in the markets. Jerome Powell (the Fed chairman) was renamed as a serial ...CONTINUE READING

Bear Market - How long will it last ? (08-09-2022)

Drip, drip, drip. I had a client last week tell me that this bear market just seems to drag on and on and on. She asked, “how much longer with this ....CONTINUE READING

Bear Market - How long does it take to Recover ? (6-24-2022)

"It was announced on JUne 14th, 2022, that we are officially in a Bear Market for the S&P500. The NASDAQ index was declared to be in a Bear Market almost ...CONTINUE READING

"Put the Lime in the Coconut and Drink it All Up." (4-29-2022)

"Inflation is funning Hot, here comes the Fed." ..."Is the Stock Market a Leading Indicator?"...Short Recession ?" What about Bonds ?" ..CONTINUE READING

Whoopty Doo. But what does it all mean..." (2-17-2022)

"I will get to this famous Austin Powers quote later in the newsletter. But if you remember my January newsletter, I emphasized how I expected a rockier market in 2022. Well, guess what ? That's what we have gotten so far. The market is currently in ...CONTINUE READING

Goodbye Year 2020 ! (1-6-21)

"Hit the road, Jack ! And don't you come back. No more, no more, no more, no more ! Hit the road Jack. And don't you come back no more..! " Ray Charles recorded this song in 1961 and I believe this song reflects how most ...CONTINUE READING

Economy - Recovering - Accelerating (8-20-20)

Certainly, the most frequently asked question I get is, how can the stock market be doing so well when things appear to be so bad ? ...Let us just focus on the stock market and this ....CONTINUE READING

April 2020 - Tough Month (4-3-20)

This may be the understatement of the year. Supposedly as we head into the peak or the peak of this coronavirus, I hope you are doing well.. this beark market is different because not only are people worried about their ...CONTINUE READING

Bear Market - Straight Talk (3-17-20)

During this recent market meltdown, I happen to look back and noticed that this was the sixth bear market that I've experienced...During this economic downturn, certain businesses are grinding to a ...CONTINUE READING

Stock Market Meltup OR Down? (5-10-19)(# 2535097.1)

What a difference a few months make. Perhaps I don't have to remind you of the market correction/bear market in the last quarter of 2018. It cumulated into what they call "The Christmas Eve Massacre." Traditionally, the market doesn't go dow a few days ...CONTINUE READING

Tax Man or Stretch IRA ? - Leaving a Legacy (3-28-19)

The stretch IRA concept, which I have implemented for almost 20 years, is truly one of the most powerful money/investment techniques that I know, that doesn't cost ..CONTINUE READING

Fiduciary Duty - Does your Planner owe it to you ? (2-28-19)

In 1968, Archie Bell and the Drells unleashed a hit song called “Tighten Up.” More about the song later. With market volatility hitting extreme levels in October and continuing into November, I'm fielding more calls, emails, and questions, not only from ......CONTINUE READING

Tighten Up Investor - Market Volatility (12-7-18)

In 1968, Archie Bell and the Drells unleashed a hit song called “Tighten Up.” More about the song later. With market volatility hitting extreme levels in October and continuing into November, I'm fielding more calls, emails, and questions, not only from ......CONTINUE READING

My 86-year old mother - weed stocks (07-19-18)

I bet you that title got your attention! A month ago I received a phone call from my mother and she asked me a question that I've heard multiple times from retirees over the last four or five years. How do I exactly buy some of these companies that are selling this marijuana? My mother said ....CONTINUE READING

Fed Raises Rates for the 7th Time (07-05-18)

I listened to our new Fed chairman, Jerome Powell, on June 13th, 2018. It was refreshing to hear the new Fed chariman speak in actual plain English. His predessors, both feds and economists, were so .......CONTINUE READING

I have met the World's Worst Investor (5-22-18)

Over the years, I have had many clients comment to me during our initial meeting claiming to be the worst investor. I have finally met the world's worst investor last week ! He was an aeronautical engineer and he creates and runs .......CONTINUE READING

My Favorite Chart (4-23-18)

I have used an updated version of this chart for 20+ years. It represents what a long-term structural markt looks like (sometimes called a secular market). I ahve received many questions about how long this bull market ....CONTINUE READING

Who Dunnit? February stock market (02-16-18)

You as an investor have witnessed stock market declines of 1,000-points in just the first week or so of February. It's been quite a while since we have seen this kind of ....CONTINUE READING

Can the 2018 Stock Market outperform 2017 returns? (01-15-18)

I don't think anyone can argue that the last year in the stock market was about as good as you could've hoped for. However, going into 2018,a week goes by when I do not field questions about what direction the market is heading....CONTINUE READING

What Kills a Bull Market? (09-29-17)

Not a week goes by when I do not field questions about what direction the market is heading. "The media pronounces that tomorrow at 9:30 sharp the market is going to crash." " The market is going down because of the presidential job approval." "The market is toast because of BREXIT." "The market is going to bust because of the .....CONTINUE READING

What is the Market cooking ?(08-24-17)

I A former professional wrestler called "The Rock" is on TV, movies, and Netflix. You pretty much can't go anywhere without seeing the personality of "The Rock." As a former wrestler, he had build his entire career on jumping up on the rope and getting the crowd psyched up by saying, "Can you smell what The Rock is cooking?" And now The Rock is thinking about running for president ! I will get back to The Rock in a little bits, but let's talk about ....CONTINUE READING

My Favorite Chart (05-19-17)

I have used an updated version of this chart for 20+ years. It represents what a long-term structural market look like (sometimes called a secular market). I have received many questions about how long this bull market can last, and I always reference this chart to show that structural markets last for a very long time. Let me elaborate a little more on that. When we look at the chart it says .....CONTINUE READING

“Houston, all systems go!” (03-22-17)

Do you remember when America was on the way to the moon? Or perhaps you were too young to have seen some of the Apollo missions/rockets (years 1961 - 1975). Back then, we only had three channels on the television and the whole nation watched the countdown to the major rocket launches (i.e. Apollo Missions). Luckily for me ......CONTINUE READING

One Chart that Explains it All (02-06-17)

It's all about growth in the economy, or lack of. Take a look below at the wonderful chart done by Oppenheimer that shows GDP (gross domestic product) since 1966 [1]. It presents an average of about 3% GDP growth. Well, in the last eight or nine years it has been subpar. Many of .....CONTINUE READING

Is It Morning in America ? (11-16-16)

My son Nick is in a one-year countdown to exiting college and going into the job market fulltime. He recently asked me if the election results could affect future employment opportunities. I said, "Nick, don't focus on politics. Instead focus on the ............CONTINUE READING

Bull Markets Don't Die of Old Age.... Recession (8-31-16)

I have been asked numerous times how long do bull markets last? Perhaps a pundit has been on television describing the reason why the market cannot go up, because the market has aged past the normal .......CONTINUE READING

----------------------------------------------------------------------------------------------

Take the Win and Be Happy

Let's go out and enjoy the outdoors before the heat comes roaring in. We probably have about six to seven weeks. You know I look back on January 12th when I came out with my stock market prediction, which I do every year, which is a real gamble, but I went ahead and committed it to paper. I said I thought we would end up with an 8% to 12% return for 2024. So far, right on target. I want to go back and rehash some of the indicators that I mentioned back in January https://www.romanojohn.com/Our--Newsletters.11.htm for reasons to be happy about the market. And then I'm going to talk about some new ones.

• Federal Reserve Policy: The Fed is expected to continue lowering interest rates, which is seen as positive for the stock market.

• Impact on Industries: Lower interest rates are expected to stimulate demand in various industries related to housing, such as construction, manufacturing, and home appliances.

• Impact on Investments: With the Federal Reserve easing, yields on money market accounts, CDs, and savings accounts are likely to drop, potentially leading some investors to allocate more funds into the stock market.

• Stock Buybacks: a move that could reduce the supply of available stocks and potentially drive-up prices, making it an opportune time for investors. Expected buybacks are up to 1 trillion this year. (1)

• Wealth Effect: Positive stock market performance and increase of housing values tends to stimulate consumer spending, further boosting the economy.

I’ve Saved the Best for Last

Thanks to advancements in artificial intelligence, I'm witnessing anticipated boosts in productivity that border on the incredible. We're talking about achieving productivity gains in the double digit. Ordinarily, the U.S. economy sees growth rates of 2% to 3% annually, but projections indicate a significant surge beyond that range. While the exact extent of this growth remains uncertain, it's expected to mark the most substantial productivity leap for American workers since the internet. I do know that when companies enhance productivity, profits follow suit, ultimately propelling market dynamics.

Reflecting on my own journey, I recall being advised early in my career that I wouldn't reach my full productivity potential until I enlisted assistance to handle administrative tasks. Taking heed, I promptly acquired such support. Consider, if you will, whether you're now retired or if you have conversations with younger generations, the pervasive challenge of administrative burdens faced by many Americans. They often find themselves mired in paperwork and tasks they'd rather not undertake. Imagine the potential productivity gains if everyone had access to one or two assistants.

While such resources might not have been feasible in the past due to various constraints, the advent of artificial intelligence raises intriguing possibilities. Could AI provide virtual assistants to alleviate mundane tasks for everyone? I know I couldn't do what I do without my administrative help. And this is where the productivity is going to come in. It will be great to see.

Many Thanks

I wanted to thank you all for the great referrals. Back in January, I mentioned that we wanted to bring in some new clients, and I think we had a target of 24. And we have done about 40% of that. And that's all thanks to you! You referred us to some of your kids, and your friends, and we really appreciate that. Let's take the stock market wins in 2023 and 2024 and be happy. Have a great spring!

Best Regards,

John Romano, CFP®

Office Phone #: 352-753-8590

Email: john@romanojohn.com

References:

1. https://www.vox.com/future-perfect/24108787/ai-economic-growth-explosive-automation

Data contained in this newsletter is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC) and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored.

Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential, and use by anyone who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

Santa Claus Delivers/John's Predictions for 2024/Hey, I Need Your Help...

In 1968, Yale Harsch introduced the concept, or the phenomenon, of the Santa Claus Rally. It was a rally held in the last couple of weeks of December. While it does not work every year (nothing does), it sure worked this year. The long-term investor in 2023 who did not get head faked out of the market was rewarded as they should be.

John's 2024 Prediction

Well, it's about that time when everybody starts making their stock market predictions for 2024. Well, here's my two cents. The market's going to go up, and it's going to go down. Hey, I can't go wrong with that one, right? Keep reading on to get the real prediction.

Data points

Based on data points, not your Aunt Nervous Nelly, who tells you over the holidays every year that the stock market is going to crash and it's going to be like the Great Depression. Instead, let's look at some recent data points:

• Interest rates are not only not going to be rising, but they will be actually going down. I believe this will stimulate the housing market because there is so much pent-up demand. People weren't moving and weren't buying because of the close to 8% mortgage rate, but I believe as rates get closer to 5 or 6%, they will.

• Also, the ancillary industries that are directly related to the housing market, whether it's construction, manufacturing, furniture, concrete, timber, copper, refrigerators... these industries will pick up, and unemployment will go even lower.

• Speaking of unemployment, it's already historically low, and you know what they found about the consumer? As long as they have no fear of losing their jobs, they will keep spending.

• This is the real biggie. The Fed is seemingly not going to be raising rates, but indeed, the prediction is to lower rates two to four times this year.

• The onshoring boom of bringing back factories to the U.S. is up, and last year, it's up a staggering 71% year over year, and over a two-year period, 131%. COVID taught us that we not only need to shorten the supply chain but also to move more of these important factories back to this country.

• Small and mid-cap stocks have joined the bull market party, which leads to a much broader market.

More importantly, I believe the fear of COVID has faded. Now, I'm not downplaying the severity of the virus. But after having it and watching everybody I know have it at least one time in 2023, we have just learned to live with it. The morbidity of sheltering in place, hiding in your house, being scared to even talk to people, much less going outside, had a tremendous effect on the psyche.

Just the optimism of going out and living life, enjoying the activities, can’t help but improve your optimism. If you're going to be an investor, you're normally an optimist, thinking that you're going to be around sometime in the future to enjoy these funds. But if you are at home, sheltered in place, scared to move, it leads to some real pessimism, which I think is bad for investing. Now, I could be off base on this, but I don't think so.

Age of Aquarius

I heard this song called Let the Sunshine In over the holidays by a band called the 5th Dimension. They were talking about the stars and moon being aligned. [1]

VERSE: When the moon is in the Seventh House, And Jupiter aligns with Mars, Then peace will guide the planets, And love will steer the stars

CHORUS: This is the dawning of the age of Aquarius, Age of Aquarius, Aquarius, Aquarius

My Final Prediction

I’m not sure if the stars and moon are aligned, but I think the data points for a good stock market in 2024, so here you go, drum roll, please... My prediction of the market return is 8 to 12%.

Thankful

You know, it seems like over the holidays, I always run into an investment advisor whom I've known my whole career. He's about ten years older than me, and our conversation always centers on how lucky we both are to be in this investment advisory business. There's no thought of retiring for him or for me. It's a great business, not only monetarily but also because it allows me to do the things I want.

Over the decades, I've had the chance to help hundreds if not thousands of retirees to live not a worry-free retirement (because there's no such thing) but worry less about their biggest fear, which is running out of money. And I know this because my clients tell me this on a weekly basis. Indeed, I get calls and letters from their loved ones saying things like thanks for taking care of my mom or dad. Furthermore, some of my clients are in their seventies and eighties, and I normally do three-way calls with not only them but also their children. Their children want to be involved, but they're probably at the peak of their careers right now, and they're probably still raising their own families. It's just comforting to them to know that somebody is down here looking out for Mom or Dad. So, thank you greatly for letting me serve you.

I need your help.

Hey, I need your help. As many of you know, I get all my business from referrals. I've told the team in 2024, I think I'd like to bring in about 20 or 24 new clients. So, if you know:

- One or more of your children who have the bulk of their net worth in a 401k and are getting no help.

- Somebody you know is getting ready to retire, and they are wondering how to create income streams.

- A friend who just lost a spouse who took care of all the financials.

- Any person that you know who is not happy with their current advisor.

- If you have a good candidate call Margaret at our office, or email us.

Please send us the contact information so my office team can reach out to them. We may not do business with them, but we will treat them like we treat you.

It may not be the age of the Aquarius, but let’s have a great year!

Sincerely,

John Romano, CFP®

Office Phone #: 352-753-8590

Email: John@RomanoJohn.com

Data contained in this newsletter is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC) and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential, and use by anyone who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

[1] https://genius.com/The-5th-dimension-aquarius-let-the-sunshine-in-lyrics

We watched the regional bank industry experience a "Back to the Future" event. You remember the financial crisis when banks failed in 2008. Fortunately, it is not as bad as 2008, but perhaps it could have been avoided. Make sure you read the last section of this newsletter because there is some good news.

Janet Yellen, the treasury secretary, whose job is to monitor the bank industry, just a few days before the crisis unfolded on March 10th, spoke at a climate conference. Her presentation said that climate change would likely become a source of shocks to the financial system in the coming years(1). While she's up there talking about the weather, the banking industry actually had a financial shock. In essence, there was an old-fashioned run on the banks because of facts, not rumors, getting out that some regional banks had more liabilities than assets.

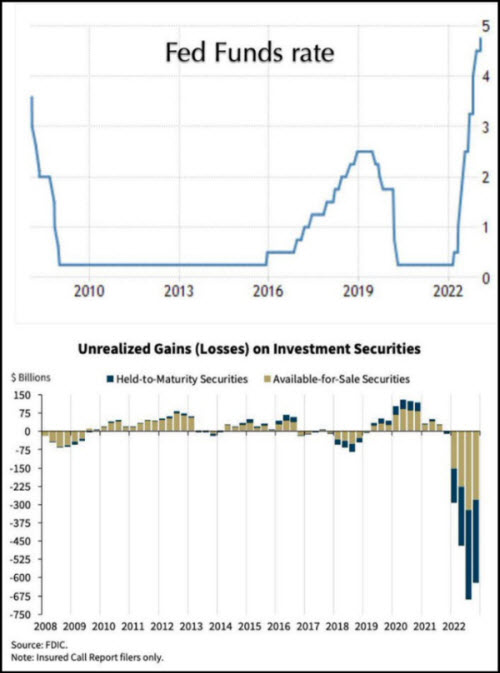

In the SVB case, they were the first bank that experienced a known problem and had received so much money and deposits in 2020, 2021, and 2022 that they were out buying 10-year treasuries. Unfortunately, these 10-year treasuries, the yield was 1.5%(2). So, the Fed starts raising rates like they had talked about for a couple of years, really in 2022, and as most people know, when interest rates rise, the principal value of bonds drop. You may wonder why the banking industry was covering, in essence, one-day deposits with 10-year bonds. In other words, if your depositors wanted their money, you had to sell those bonds at a loss.

Please see the chart below from an article by David Sacks(3). His illustration better explains what's going on with the banks than anything I've seen. This illustration shows the banking industry's bond portfolio on the bottom and how much value it lost as the Fed raised rates(top of the chart). Losses are in hundreds of billions of dollars.

The Four Steps to the Banking crisis:

Step #1: The government prints and passes out free money to anybody who can fog a mirror, plus passes multi-trillion-dollar spending bills, which causes the worst inflation we've seen in 40 years.

Step #2: To combat inflation, the Fed raised rates very aggressively, driving down the principal value of the bonds banks had purchased.

Step #3: This made a few of the banks technically insolvent. If there was a run on the banks - oops.

Step #4: Yes, Mildred, there was a run on the banks.

No Soft Landing Here

Chairman Powell has been saying for months that they are hoping to have a soft landing, which equates to raising rates enough to lower and calm inflation without triggering a monetary crisis. Well, you can't really say mission accomplished with this one!

Fortunately, the government will step in and ensure no depositors are hurt, regardless of the amount they hold at a bank. Banks will be forced to tighten up, and their costs will increase due to having bailed out the few affected banks. Banks will have less money or will be more reluctant to loan money. Currently, 30% of the loans in the country are done by regional banks(4). Do you expect more loans or fewer loans? I expect fewer loans, so we'll have less economic activity. But hold on; there might be some good news for you.

Hidden Gem

It’s time to go long. Believe it or not, there's a gem in the coal mine caused by the fed raising rates. It may be time for you to go long with certain investments. Specifically, I'm talking about fixed income, whether a bond for three to five years, a CD for one to four years, or even a multi-year guaranteed fixed annuity for two to seven years. It's been many years since I've discussed this concept of going long. The last time was back in 2007 - 2009, and interest rates peaked in that business cycle. At that time, you could get 5- 7% on the above-mentioned investments and lock in a maturity date of 2 -5 years. Then we saw rates decrease for years.

Why do you need to go long? It’s not just football terminology. Going long refers to a maturity that exceeds one year. You go long if you think interest rates will decline or the economy is entering a period of uncertainty. Consider going long to lock in a decent return. I believe we'll see rates start going back down in about a year and a half.

Right now, the sweet spot on these kinds of investments looks anywhere from one to four years. Of course, every investor's situation is different. You can't just willy-nilly and go out and take advice from a newsletter without consulting with a qualified investment advisor. As always, please feel free to call me with any questions.

Sincerely,

John Romano, CFP®

Office Phone #: 352-753-8590

Email: john@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

(1) https://home.treasury.gov/news/press-releases/jy1325

(2) https://gulfnews.com/special-reports/biggest-bank-collapse-after-2008-global-recession-how-svb-spectacularly-failed-after-rate-heresy-becomes-reality-1.1678543355308

January 2023 Barometer Effect - Myth or Reality?

Before I get to the January Effect, let's just recap last year. As you probably know, nothing good happened in the markets. Jerome Powell (the Fed chairman) was renamed as a serial inflation killer. His mission impossible, which he decided to accept, was to raise rates to kill inflation and hopefully have a soft landing.

It was tough on almost all areas of the markets with the Fed raising rates very aggressively, there was no place to hide if you owned almost any asset class. Equity markets took a beating, bond markets had a tough year, real estate properties declined, and even Bitcoin took a major beat down - the tide was definitely going out. So long 2022, it's good to see you go.

With the purge of last year's market, is there a light at the end of the tunnel? So far in the month of January with positive returns in the 4% to 5%, have we turned the corner? Let's talk about the January Barometer Effect. The January Barometer Effect was first discussed by Yale Hirsch in the seventies. His study, which was just updated in 2022, showed for the last 50 or so years, that if the market had a positive return in January, it predicted a positive return for the year.

Here is what I expected:

- In 2022, we had a bad market in a decent economy.

- In 2023, we expect a worsening economy in a decent market.

- New market leaders will not be the big tech companies (Google, Facebook, Amazon, Netflix) but more big industrials, Boeing, Caterpillar, and John Deere.

- China's economy will tank for the next three to four months as Covid takes a massive toll, but their economy should start expanding toward the end of summer.

- International markets have started out with the best year we've seen in the last 10 or 15 years.

- Bond yields are looking rather well.

- We will probably not have a soft landing.

- Home prices will, and have probably already dropped around 15% to 20%, but there will not be a 2008-2009 collapse because of lack of supply.

- Demand will continue to cool for all high-ticket items that require financings such as homes, boats, and RVs.

- Ukraine could be the wild card if there's not a negotiated settlement soon.

As always, my job is to rotate portfolios in the right sectors, but the tide is coming in this year, unlike last year when it was definitely going out. So far, so good.

Best Regards,

John Romano, CFP®

Office Phone #: 352-753-8590

Email: john@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend, and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future result.

Bear Market- How long will it last ?

Drip, drip, drip. I had a client last week tell me that this bear market just seems to drag on and on and on. She asked, “how much longer with this Chinese water torture?” My response was, “well, I’m not too sure about this Chinese water torture thing, but I and most investment advisors are watching the Fed's next two or three rate raises - as the next opportunity the Fed can raise rates would be in September, November, and possibly in December.” I believe that after these three rate raises, they will have sufficiently raised rates enough to slow the economy down, and with it, inflation.

The economy is already slowing down. Home sales are going down, car sales are going down. Even Walmart is complaining that they're not able to sell merchandise on their non-produce side of the store. As mortgage rates have hit a 15-year-high, home sales and new home starts have dropped very significantly. It's interesting to me, that if you look at some of the car lots 7 - 8 months ago there were no new cars on the lots, and now you noticed the lots are starting to fill back up.

When do bear markets end? Well, Mark Hulbert published an article, CLICK HERE ON THE LINK TO READ:

He studied multiple bear markets and their correlation to the Fed rate rise. He noticed in the last six bear markets, that the market bottomed out 2 months before the last Fed rate rise. He also studied the performance of the stock market after the bottom. Ultimately, the average 1-year return of the S&P500 after the market bottomed was 25%. I believe the last rate hike will be in December, so it is possible the market will find a bottom and course in October.

The biggest wild card out there today is Europe because to quote a phrase from the HBO series Game of Thrones, “Winter is coming.”(2)

Energy prices have quadrupled in Europe primarily for two reasons, Putin's control of the natural gas pipeline and our dependency on green energy. I believe energy costs will not only make it a challenge for the industry, but I think that this winter we will see wholesale rationing. Europe is looking at a much more intense recession than we face.

Riddle me this. Since California has announced the phase-out and the complete ban on gas combustion automobiles in 2035 – how is this going to work? California now has about half a million electric vehicles with about 22 million gas autos. Over Labor Day, because of the power outages, they asked people not to charge their electric vehicles. If the electric grid cannot handle half a million vehicles today, then how in a few years can it handle 25 million? The answer is it can’t!

Don’t fight the Fed. When it is all said and done, I believe that the Fed is on the right course of raising rates. It will in all (most likely) worsen the economy. However, I think most Americans would rather have a short-term worsening economy versus multiple years of high single-digit inflation.

Best regards,

John Romano, CFP®

Office Phone #: 352-753-8590 Email: john@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

(1) The stock market typically bottoms before the end of a Fed rate-hike cycle. Here's how to make that bet pay off. - MarketWatch

(2) https://ew.com/tv/2019/03/27/game-of-thrones-best-quotes/

Bear Market- How long does it take to recover ?

It was announced on June 14th, 2022, that we are officially in a Bear market for the S&P 500. The NASDAQ index was declared to be in a bear market almost 3 months ago.

Personally, this is my fifth or sixth bear market as an investment advisor and I can't remember one of these bear markets as being fun for anybody.

There is hope, but first, let's talk about what got us here.

- The government passing out trillions of pre-monies over the last two or three years.

- The Fed cutting rates to zero and pumping trillions of dollars into the economy.

- Threatening oil companies make it harder to borrow money to bring on new production.

- The war in Ukraine.

These four factors, plus a few others have led us to the highest inflation rate we have seen since the 70s. One of the new pastimes in America is when you were on your way to work to check out the oil prices and on the way out you check to see if they had gone up very much. So, America is witnessing the highest inflation that we've had in this country since the late 70s.

Jerome Powell (inflation killer)

Well here comes the inflation killer Jerome Powell 'The Fed Chairman'. He is aggressively raising rates to shut off demand. This is the only tool that the Fed has left to fight inflation. You must shut off demand for high ticket items which people were borrowing money on at almost not zero rates, but close to that.

Home Prices for example. Just three or four months ago you were able to get a 30-year mortgage at a rate of 2.90%, now that same 30- year mortgage rate is close to 6%. So, raising rates will shut off demand for big-ticket items - whether it's a home, a boat, a second home, a car, or anything where people normally borrow money and pay for it over time.

Unfortunately, when you shut off demand for these kinds of items, unemployment goes up. And then what normally follows that rise is a recession. The signal of a Recession is having two-quarters of GDP being negative or zero, and we've already done that in the first quarter, who knows where we're at in the 2nd and 3rd quarters.

Good news

As soon as the Fed see these rates taking effect going forward and shutting off demand, they will not be as aggressive in raising rates or maybe even slow the whole process.

What to expect from the stock market?

The average bear market lasts anywhere from 7 - 9 months. The method to count the time in a bear market is once a bear market is declared(June 14th S&P500) you go back and start counting the months the market started going down. In this case, it was January of 2022, so we will already be at month 6 or 7 therefore we are much closer to the end than the beginning.

In 10 of the last 12 bear markets, if you would have bought the S&P500 the day that a bear market was declared, you would have averaged 22.7% in the next 12 months(1).

The stock market is always 6 - 9 months ahead of the economy. And this year when the market started to go down, in January, it was spot on. Again, this is a Fed-induced recession whereas demand and prices dropped, the chairman will slow the rate hike.

One last caveat.

In the Bank of America article published June 17, 2022, by Barbara Kollmeyer, she explained that in the next phase, once the bear market stops, then a bull market starts. The average bull market lasts about 64 months, and she is projecting “the S&P will be at 6,000 by Feb. 28th”(2), almost a double from here.

Remember what sectors lead the last bull market almost never lead the new one.

Best Regards,

John Romano, CFP®

Office Phone Number: 352-753-8590

Email: John@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

- https://www.marketwatch.com/story/those-who-buy-stocks-the-day-after-the-s-p-500-enters-a-bear-market-have-made-an-average-of-22-7-in- 12-months-11655224023

- https://www.marketwatch.com/story/based-on-history-the-next-bull-market-is-just-months-away-and-could-take-the-s-p-500-to-6000-says-bofa- 11655475414?mod=search_headline

“Put the Lime in the Coconut and Drink it All Up." -Baha Men (1)

Do you remember the song Put the lime in the coconut? It was originally released in 1972 by Harry Nilsson and redone by the Baha Men. The narrative of the song presents a woman who had a stomachache late in the evening, and she called her doctor. He didn't want to see her, so he told her to put the lime in the coconut and drink it all up. You may be wondering what this has to do with the stock market.

Before I dive into more details about the lime in the coconut miracle fix. I wanted to mention something I saw a few weeks ago on CNBC. It stated that 81% of Americans believe the U.S. will experience a recession within this year. (2) I was shocked because normally they go out and poll 100 different economists and come back out with all these realms of data. Their findings would be very inclusive because they would straddle the fence. I believe this poll done by asking the average American is spot on because many of them are driving by the gas station wondering what gas is going to cost this afternoon. They're going to Publix or Walmart for their groceries, wondering if they're going to spend $200-300?

People have been priced out of home buying because the average house has gone up 20-25% in the last year. And if they can't afford to buy a home, their rent has gone up 20%.

Inflation is Running Hot, Here Comes the Fed

So, Fed Chairman Powell is now going to crush inflation without crashing the economy. In Fed lingo, this means engineering a soft landing. He's going to put the lime in the coconut by raising interest rates. His goal is to shut off demand, which should cool inflation very quickly. It will be very interesting to see if he's able to engineer a soft landing.

For example, if you bought a home a year or so ago, I believe the average house price was about $350-370,000. Your mortgage rate was 2.95%. Fast-forwarding to today, the average home price is $440,000 and your mortgage rate is now 5.4%. So now you're going to spend almost two percent more on an interest payment on a higher purchase, which equates to serious money.

Chairman Powell’s goal is to raise interest rates, which will shut off demand and maneuver to a perfect landing. To put this in a simple context, the American public will now say, I'm just not going to pay that, whether they're looking to buy a home, a car, or a new computer system.

Is the Stock Market a Leading Indicator?

Yes, it is my belief that the stock market as a whole is a leading indicator. Think back to our last recession, which was just two short years ago in year 2020, except the last two years have been anything but short. They seem more like two long years. If you can recall, the market had started going down in the first couple of months of 2020, and then finally, we had the pandemic and pandemic-induced recession. Now, that recession was very short-lived. Even though the market had dropped 25-30% in just a couple of months, by the end of the year, the stock market had not only recovered the losses, but the S&P had a pretty good return of 18%.(3)

Short Recession

I believe this will be a short recession because it's a Fed-induced recession. Once they see demand drop, inflation should move down rather quickly, and they can stop raising the rates. While they can't turn this big economy around overnight, they can certainly point it in the right direction. New home sales dropped in March by about 9% from the prior year. I was talking to a banker the other day, and he had said they had started laying off mortgage brokers. I was also talking to a boat salesman, and he said up to the last month or two, you couldn't get any inventory, and now there's nobody in the showroom.

So maybe the higher interest rates have already taken effect. Furthermore, I believe a huge factor is consumer sentiment, and it is way down. And that's understandable. By seeing all these costs go up, people just are making up their minds, and they're just not going to buy that item. Obviously, they must pay for certain things, but nobody's forcing them to spend money on discretionary/luxury items.

Negative GDP Numbers Just Came Out

For the first quarter of 2022 negative GDP numbers were reported for this period of time. This is the first negative GDP numbers we've had since the second quarter when the pandemic had shut the country down. Now, don't worry, the same people who said inflation was transitory say they are not concerned about a recession.

What About Bonds?

I've had a lot of questions about bonds lately. Unfortunately, you can't buy bonds at this time because as interest rates rise, bond values drop. Fact is, the S&P is down about 15-16% as of the end of April. And the average, high-quality bond is down about the same percentage. Bonds react very negatively to rising interest rates.

So, What Have I Been Doing?

I've spent the last 4-5 months repositioning portfolios away from large growth companies which do terrible during recessions. The stock market has been pricing that in by going down on these particular sectors. Growth has been the best sectors for many years. Well, it isn't anymore. The good news is there are other types of companies, which most people would characterize as consumer durable companies, such as utilities, energy companies, grocery stores, auto parts stores, railroads, and health care, which are doing just fine.

So, Dr. John says has put the lime in the coconut and maybe add some rum and drink it all up. And as always, I stand ready to make changes to your portfolio based on the current conditions.

Sincerely,

John Romano, CFP®

Office Phone Number: 352-753-8590

email: John@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

1. https://genius.com/Baha-men-coconut-lyrics

“Whoopty Doo. But what does it all mean...”– Austin Powers (2)

I will get to this famous Austin Powers quote later in the newsletter. But if you remember my January newsletter, I emphasized how I expected a rockier market in 2022. Well, guess what? That’s what we have gotten so far. The market is currently in a correction, I believe it started about the second week of January.

Corrections are normal

In fact, there have been 26 market corrections since WWII but with an average decline of 13.7%. The average recovery time in a correction is about three months.

The market is resetting itself for the future, interest rate hikes are coming, and the Fed is going to be shrinking its balance sheet. In English, this means the Fed is no longer going to be pumping trillions of dollars into the system while the government is handing out trillions of dollars of free money.

In 2021, with all this money flowing through the system and people spending it, it provided a tailwind for the economy. Think back, a lot of the people have been locked down for a year or two, and they were itching to get out and spend their money. People were bidding up the prices of homes as well as the prices of cars.

Unfortunately, now the party's over with.

Inflation is running hot, and I mean it is sizzling.

As a sidebar, if you discuss inflation was somebody under the age of 45 or so you might receive a blank stare because we have not had high inflation since the late ’70s. Well, for Millennials and Generation Z, school is in session. What is inflation? In a nutshell, inflation is when you're driving to work in the morning and you have half a tank of gas, but you feel like you need to fill up now because gas prices will be up later in the day.

"If it looks like a duck, walks like a duck and quacks like a duck, it's probably a duck”. - Albert Einstein.

Yes, I know Albert Einstein did not say this, but I may be going out on a limb here but some of the indicators are flashing recession in 2023.

Indicators:

- Billionaire bond investor Jeffrey Gundlach said, “Consumer Sentiment plunged on Friday to a fresh decade low, and that’s been a reliable leading indicator as to where the economy is headed in the future.” (1)

Normally when people have a bad feeling about the economy, they tend to not spend as much money.

- James Ballard of the Federal Reserve said on Valentine's Day, “I do think we need to front-load more of our

planned removal of accommodation than we would have previously...”(3) He supports raising interest rates by a full percentage point by the start of July and it appears he also wants to have 3-5 others this year.

- Bullard’s plan involves spreading the increases over three meetings, shrinking the Fed’s balance sheet starting in the second quarter, and then deciding on the path of rates in the second half based on updated data. (3)

- No more free government money will be passed out this year.

- The 10-year Treasury yield from January went from 1.5 to over 2% in one month.

The reason I see a recession in 2023 is because the Fed is going to be raising rates very aggressively. It has been my experience over the years that it takes eight or nine rate rises to really shut off demand. For example, do you think many homeowners today that are sitting in a house paying a 3% mortgage would move across town if the new mortgage rate was 6%?

Whoopty Doo, what does it all mean…?

If you were an Austin Powers movies fan, whenever he got a lot of data points, he would blurt out of

frustration, “Whoopty Doo, what does it all mean...? (2) Well, basically it means we're in a rising interest rate environment, probably headed in a recession in around two years.

The bad news

- Interest rates are heading up.

- Some stock market sectors are going to underperform. And indeed, some companies with business models predicated on low-interest rates probably won't be around here in a couple of years.

The good news

- You will probably see a little better rates on your savings/checking accounts.

- Prices will come down and so will inflation. Some stock market sectors are going to not only do well but flourish in this environment.

- Companies that have reasonable business models with products that people will need will move to the forefront - think energy, transportation, consumer staples, banks, agriculture, commodities, and utilities.

The proper way to deal with not only this correction but more importantly, the economy, is to consistently rotate into the sectors that outperform in that kind of environment. My job is to find those sectors and rotate in. But this is exactly how I've been managing my clients' accounts for years.

Sincerely, John Romano, CFP®

Office Phone Number: 352-753-8590

Email: John@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years’ experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

- https://markets.businessinsider.com/news/stocks/jeff-gundlach-economic-recession-possible-this-year-consumer-sentiment-weakens-2022-2

- https://viebly.com/austin-powers-quotes/

https://www.bloomberg.com/news/articles/2022-02-10/fed-s-bullard-backs-supersized-hike-seeks-full-point-by-july-1/ https://markets.businessinsider.com/news/stocks/fed-rate-hikes-front-load-james-bullard-inflation-credibility-cpi-2022-2/ https://www.livemint.com/economy/feds-james-bullard-supports-raising-interest-rates-by-a-full-point-by-july-11644549964159.html

https://www.bloomberg.com/news/articles/2022-02-10/fed-s-bullard-backs-supersized-hike-seeks-full-point-by-july-1/ https://markets.businessinsider.com/news/stocks/fed-rate-hikes-front-load-james-bullard-inflation-credibility-cpi-2022-2/ https://www.livemint.com/economy/feds-james-bullard-supports-raising-interest-rates-by-a-full-point-by-july-11644549964159.html

The year 2019 was an easy year to be an investor and It was an even easier year to be an investment advisor! The tide was coming in. The wind was at our back. The fish were really biting - It was hard not to have great investment returns.

And, well, 2020 was a whole lot of different. Not only were the fish not biting, but the tide was also going out and we had a category five hurricane that was blowing at us, that came out of nowhere! I find it hard to believe that many people did not have a few, if not many, sleepless nights in 2020 worrying about themselves, their family, and their loved ones.

From an investment advisor’s perspective, it once again proved to me that you better have and utilize a rules-based investing plan.

Last year's headlines between the pandemic, the election, and the economy, I had some perspective investors that told me they were sitting there in cash or running for cover. 2020 was not as quite as good as 2019, but still in my book gave a solid investment return. Anytime you can get close to a double-digit return it is a win. If you can get that kind of return while it seemed like your very way of life was going to be changed forever - Then it's a double win! If nothing else went right for you in 2002, at least the market performed.

RULES-BASED INVESTING

I first started using an investment process called Tactical Asset Allocation Using Relative Strength in the year 2000. That year signified what I believe was the end of the buy and hold strategy. It was also the start of another bad Bear market that ran for a couple, two or three years. Most investing strategies work well in Bull markets, but it is even more important to investors, how do they perform in Bear markets? We have had several Bear markets in 2000-2002, 2008-2009, and then we just went through a short-term bear market February through April of 2020.

HOW DOES THIS STRATEGY WORK?

I think the easiest example to use is a professional Football coach. When you watch these coaches from the sidelines, you know to them it is not just a game, right? The game means more to the coaches than the rest of us, yes. You don't want to see your team lose, and it is just a game, but as soon as the game is over, you've probably gone onto something else. While you are watching these coaches on the sidelines, you think their head is going to blow off their shoulders! You look at their faces and you know that their blood pressure is way up.

It’s obvious that the game is very important to them. It is not just about the money and they want to win. In professional football, there are probably three or four different quarterbacks that are all vying for the number one position. Your job as a coach is to put the best player on the field.

Well, specifically, the NFL calls this an efficiency rating. This efficiency rating is broken down by performance on the field, touchdowns, completions, interceptions, games won, games lost, etc., and they assign each player an efficiency rating. The higher the ranking in the world of football, this is a better player than somebody else with less of a ranking. It makes sense. Put your strongest player on the field, not just at the quarterback position, but at all positions.

IN THE MARKETS NO EFFICIENCY RATING, BUT PERFORMANCE MATTERS

There are about 100 plus sectors that you could allocate money to whether it's transportation, retail, health care companies, financial companies, energy companies, you get the picture. But we have even a much better rating than the efficiency rating. It is a performance rating. Now, the performance rating of not only the whole market but each sector is done on a daily, weekly, monthly, annual performance. So, it is very simple to see which sectors are outperforming now.

For example, if the transportation sector has gone up 10 or 12 percent in the last three months and the entertainment sector has dropped 30 percent, there is no question in anybody's mind which sector is stronger, right? My job as an investment advisor is to allocate money in stronger versus weaker sectors. Now my job is not to predict which sector I think is going to do better. My job is not to predict who is going to win the election. My job is not to listen to the media that tells me this or that. My job is not to listen to economic forecasts. My job is to focus on which sectors are the strongest and rotate my clients into those.

What I tell my clients, I certainly do not know where we're going to be in six months, but I will tell you where the right place to be is today. If the sectors change, we are going to change with it. (Of course, you must weigh the tax consequences of any investment decisions.) Frequently, I get a question of how long can these sectors keep outperforming? I have seen some sectors outperform for 10 years, some sectors just for 3 or 4 months. Just think for a minute of some of the high-flying companies today. Whether it is Amazon, Microsoft, Tesla, or Apple - how many years have these companies been outperforming?

JANUARY 2021 FORECAST -(Drumbeat - dum, dum, dum, dum, dum, dum, dum.)

Here's what you have been waiting for. So, what is John's forecast for 2021? I am only going to give you a forecast for right now. Unfortunately, while there are still millions of people who are not doing well in America, I think unemployment is at 6.7 percent, something like that. The reality is springtime is coming. The vaccine is here. Yes, the rollout is going to be difficult, but that is just like anything that you try to do in masses.

THE GOOD NEWS

I look around and the housing market is smoking. The international markets have finally come alive in the last two, three, four months. I have not seen this trend in many years. The big industrial companies are operating, not quite at capacity, but ramping up. And now, here come hundreds of billions of dollars in more stimulus money. Household net worth rose 3.2 percent in the third quarter to $123.52 trillion, as stock portfolios and real estate prospered (3). The Institute for Supply Management said its manufacturing index rose to 60.7% in December from 57.5% in the prior month, marking the highest level in almost two and a half years. Manufacturers have expanded for seven months in a row since the economy reopened last spring (2). Even more importantly, there is a tremendous pin-up demand for people to spend money. If you are retired, I bet there are a lot of trips, excursions, and outings that you canceled in 2020 that you are just sitting there saying, boy, as the pandemic recedes, I am going to be making it up this year.

WELL, OKAY. WHAT ARE THE TOP SECTORS? I THOUGHT YOU WOULD NEVER ASK...

Some of these sectors have been performing exceedingly well over the last five, six, seven, eight months. Technology companies, housing companies, big-box retailers, work at home software, cybersecurity. We are now seeing the market broaden out. Small to mid-cap companies are outperforming. Emerging markets, international small caps. We are even seeing commodity prices move up, if not to an all-time high. I believe lumber right now is trading up to the highest level it has seen in decades. The price of copper is going up. Even oil has moved up from its historical lows.

But even more importantly, I sincerely hope that you take care of yourself and your loved ones until we can get to the spring, and hopefully put the brunt of this awful pandemic behind us.

Sincerely,

John Romano, CFP®

Office Phone Number: 352-753-8590

Email: John@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years’ experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

(3) https://www.pymnts.com/economy/2020/us-household-worth-reaches-all-time-high-of-123-trillion/

Economy is Not Just Recovering but Accelerating

- We have recovered 40% of jobs lost during the pandemic by the end of July.

- White House economic advisor Larry Kudlow says, “There about 140 million people employed. There about 14 million people unemployed, there’s still a lot of hardship out there”. (2)

- Unemployment claims continue to ratchet down.

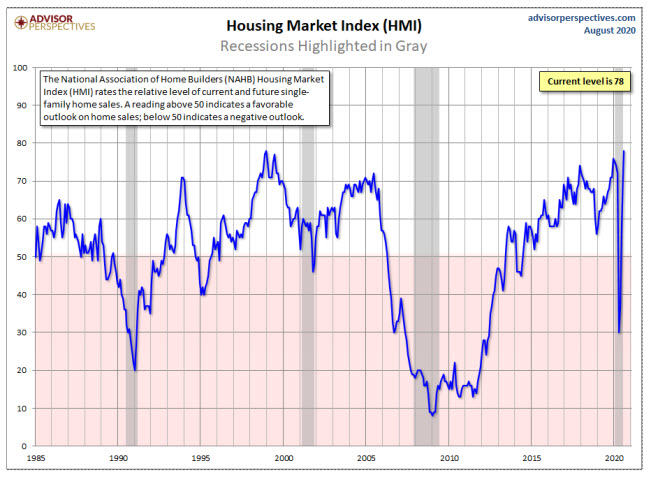

- Homebuilder confidence is an all-time high. Unlike most recessions, the housing market not only did not take a long-term hit, but the housing market is ramping up. For example, housing starting just in July alone is up 22% (3). See graph below :

April 2020 Looks Like It's Going to be a Tough Month

(This may be the understatement of the year)

Supposedly as we head into the peak or the peak of this coronavirus, I hope you are doing well. My family is safe, and I hope yours is also too. I stated in my last newsletter that this is the 6th bear market that I've been through as an investment advisor and I can tell you, every bear market feels like Mike Tyson has punched you right in the gut. This one is a little bit different because not only are people worried about their money and their jobs, they are worried about their health.

Please, let's all try to follow the guidelines of social distancing and I know I'm doing my part. I'm glad to see the governor of the state of Florida finally locked it down. Fortunately, the investment advisory business is considered essential, so the office remains open. While the office is being fully staffed, I will be working mostly from home, so I wanted to give you some contact information. Most times people don't answer their phone if it says “unknown” or they are just not sure who it is calling. So, I want to give you 2 phone numbers of mine. One is my business phone from home (407-834-8449) and then the 2nd one is my personal cell phone (407-310-3930). Always please call the office first because the office is in contact with me. The reason I am giving you these phone numbers is that over the decades I pride myself on always getting back with people in a matter of hours. It is certainly no later than that day. And you will also find the office can help you as well, perhaps you are trying to do your accounts online or whatnot.

The Market Status: As I write this newsletter in the 1st week of April, the market swings continue.

- One day up 5%

- One day down 3%

- One day up 4%

- One day down 2%

I'm sure you see the pattern. There is tremendous volatility even though I don't believe there is as much as it was 2 or 3 weeks ago. Traditionally, the stock market is priced on companies' earnings, but since earnings are going down because most businesses are closing up for this next 3, 4 or 5 weeks, I believe the market is being priced on how well or how bad on the war of this virus. Unfortunately, like in war, the market is watching a couple of indicators to see how the progress is going. It is watching the infection rate and the mortality rate. I believe these rates are supposed to peak in the middle of April - Florida maybe a week or so later. A good sign for the market would be if the infection rate and the mortality rate gets flat. It is not a good sign to you if you happen to catch the virus.

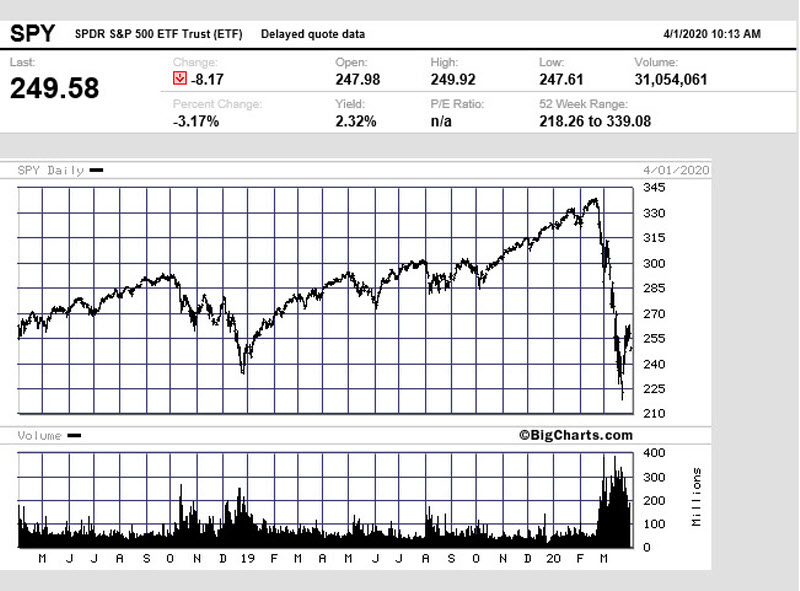

We may have hit the bottom maybe about a week or two ago. Look at the chart on the next page. It shows a couple of important things that took place in the last couple of years.

- We had a correction back at the end of 2018,

- Then we had a great year in 2019 and you can see that the market may have hit the bottom a week or 2 ago because the S&P 500 got down to 2200.

- Only time will tell. This will be very important if the market doesn't go past this area.

- Yes, we expect volatility between 2200 and probably 2600-2700. If the market doesn't violate this, then we can be pretty assured as time goes along that the bottom is in.

Source : https://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=SPY&insttype=&freq=1&show=&time=9

Potential Game Changers:

When it comes down to this war, it's not going to won by politicians or pundits on TV. But by how well our healthcare system operates. The frontline healthcare workers are utterly fearless. I really don't know how they're able to function day-in and day-out Our lives and those that we love are literally in their hands.

I'm also watching how our private healthcare companies are ramping up as well. There are 3 or 4 areas that could be game-changers.

- The 1st is the testing. The testing is amazing to watch how quickly they've been able to take a test that lasted 7-10 days down to a couple of days, down to a matter of minutes. So, I believe they have a handle on that, they just must increase production which is easier said than done.

- The second thing is the therapies that will help shorten or maybe lessen the effect of the virus. It looks like companies are really working on that and only time will tell. However, I do believe within the next 7 to 14 days we will know if there is something that will help people. COVID patients must have some kind of hope today that they can take something that gives them a chance at getting better.

- Third, the vaccines. When you understand how long it normally takes vaccines to go through testing and go into production, it's normally years. Well some of the pharmaceutical companies are doing something different, while they're testing these vaccines, they're also ramping up to do production. I believe J&J (Johnson & Johnson) has been working on a vaccine which they think if it gets approved, they'll be ready in a number of months to surge a billion vaccines.

- Lastly, the testing that will be important to really help America get back to work is this test for the antibodies. Another promising area will be the government teams are saying healthcare providers will be able to provide 60% of the individuals of working age with antibody tests by the end of April and 95% by the end of May. Individuals with elevated antibody levels will then be able to return to the workforce with minimal risk of reinfection. How many? Such tests could enable initially millions of people who have already been exposed. I believe this could possibly be a game-changer if there are millions of people in this country that have already actually had this.

Certainly, we've all got our fingers crossed for the therapies and the vaccines, but I believe that by allowing people who already have been tested, exposed, and now have the antibodies in their system to go back to work very quickly- this could be promising and would help us economically much quicker.

My job as your investment advisor is to help you recover. Understandably, nobody likes a beat down. I always remind myself how far the market has come as oppose to when I first started in the business. When I first started in the '80s the Dow was under 1,000. You can fast-forward and look at all these challenges that we've had in this country in the last 20, 30 years. We've had 9/11, The Great Recession, now this killer virus, and yet the Dow is up 20-fold in this time. I tell people never to bet against the American economy. Finally, once again, I am giving you these numbers so if something happens, if you need to talk to me, you can call me. Or if I'm trying to get a hold of you, just kind of recognize these phone numbers and maybe put them in your cell phone or whatever so you know that it is me. I wish you well and I hope you stay safe.

Sincerely,

John Romano, CFP®

Work from home Phone Number: 407-834-8449

Personal Work Cell Phone Number:407-310-3930

Office Phone Number: 352-753-8590

Email: John@romanojohn.com

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years' experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

BEAR MARKET

No happy talk, but straight talk here.